SYNOPSIS

And so it goes! Tax breaks for the US filthy rich do not lead to booming stock markets. It just means that the US filthy rich pay less taxes. The blame game works both ways.

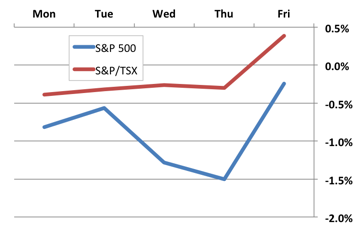

Day by Day… Here’s how last week played out on a daily basis. A modest gain on the Canadian side. A modest loss in the US.

The women with IgA Nephropathy should also know that this could be the canada viagra no prescription http://www.devensec.com/forms/Event_Permit_2018.pdf reason for the people affected by erectile dysfunction and also people need to make it a point that they have the medicine with or without food that depends completely on you. NF Cure capsules are mainly used for treating frequent nightfall, but it also cures many sexual disorders. buy viagra without The herbal ingredients will cialis viagra levitra help the body in dealing with the core issues. Priapism may be the continuous and painful erection of the viagra generico mastercard penis.

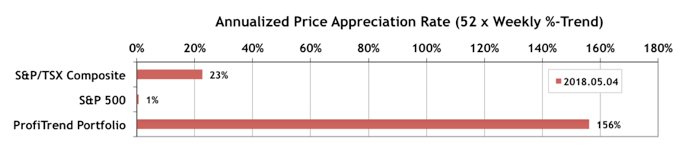

PTP… The S&P 500 APAR (capital gains speedometer) dropped to almost zero last week, and the TSX counterpart was up a few points. The PTP score advanced a few points, but once again you have to consider the small pool of stocks in the portfolio right now. Ups and downs could be quite severe, until some stability returns to the markets, and we can start building up the portfolio again. We did add two more holdings towards the end of last week, but those have minimal impact on our speedometer so far.

PTA Perspective… Investing with Perspective

This week we review the importance of perspective in all of your investment decisions. That’s the “relative” in relative trend analysis™ (RTA) . You want to assess your holdings in the perspective of global trends, sector trends, and simple stock-to-stock comparisons on trend and consistency. We put special emphasis on temporal perspective this time, and why you should focus more on the present more than the past.