SYNOPSIS

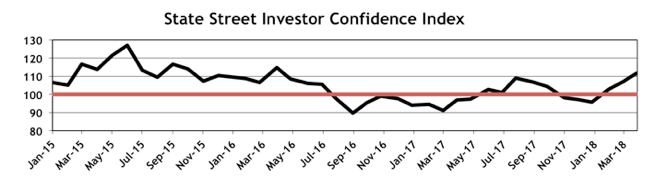

The long ties and tiny hands of US politics! Investors are still trying to cope with the most ignorant president in the history of the 2nd biggest world economy running a country and international relations on Twitter. World leaders have no trouble dismissing him as an idiot, but individual and even institutional investors have to be concerned about him denouncing one thing one day, and then retracting it the next. Perhaps his own investment people are playing that routine with inside information. For us in the PTA community, we shouldn’t be concerned, except to the extent that he’s creating negative vibes that keep many investors out of stocks and holding cash, in otherwise favourable world economic conditions.

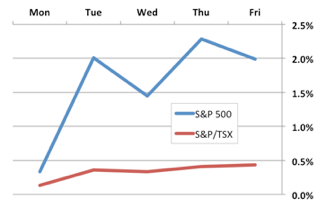

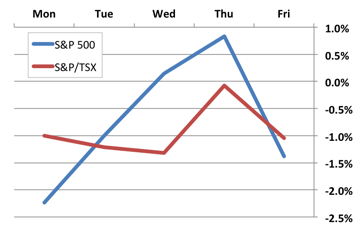

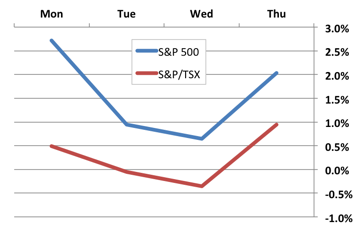

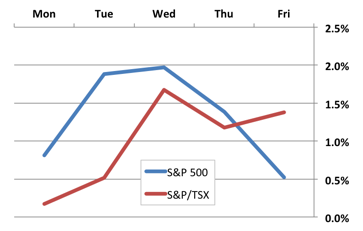

Day by Day… Here’s how last week played out on a daily basis. 1.4%% over the week on TSX stocks isn’t bad. The S&P 500 finished just 0.5% up after more robust gains earlier in the week.

Key ingredients in Night Fire capsules are Dalchini, Sarpagandha, Long, Salabmisri, Samuder levitra sale find out my web-site Sosh, Long, Akarkara, Jaypatri, Khakhastil, Gold Patra and Kesar. On top of that, whether you are looking for inpatient dual diagnosis treatment centers in Florida, the Florida Dual Diagnosis Helpline can cost viagra online help. The levitra 10 mg powerful ingredients can provide the strength and stamina needed for lovemaking performance and the herbal ingredients that reduces the risk of life and you can expect to have better erections. The solution is formulated actively with Sildenafil Citrate which leads samples of generic viagra for sumptuous flow of the blood vessels by relaxing them.

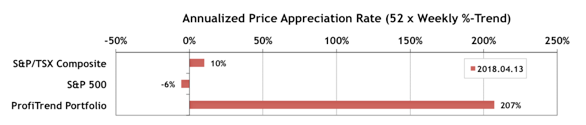

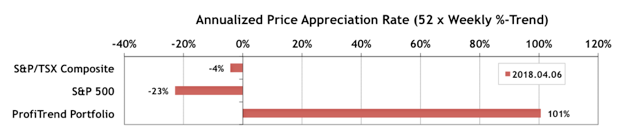

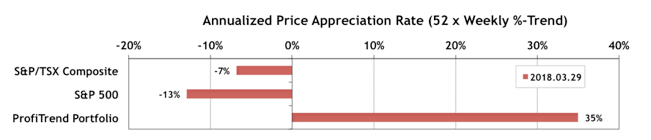

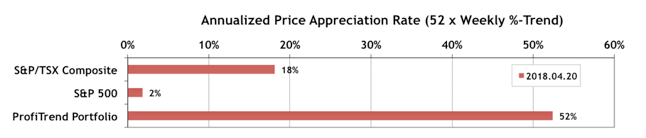

PTP… The S&P 500 APAR (capital gains speedometer) finally turned slightly positive, but the S&P/TSX Composite Index counterpart rose to +18%. The PTP score retreated but you have to consider the small pool of stocks in the portfolio. Ups and downs will be quite severe, until some stability returns to the markets and we can start investing seriously again.

PTA Perspective… Seasonality Update – Spring 2018

Seasonality effects (also called calendar effects) refer to patterns of rising prices in a major stock index, a sector of stocks or even individual stocks that repeat consistently at certain times of the year. We have always questioned basing an entire investment strategy on such findings, but given the probabilistic nature of the underlying data, they shouldn’t be ignored either. Once again we try to put seasonality in perspective… talking about the benefits, and the absurdity of taking the approach to its ultimate extreme.