NEW SUBSCRIBERS: Please visit the Visitor Guide at our web site to gain a better understanding of what relative trend analysis™ is all about. It’ll help you understand the contents of TrendWatch Weekly.

SYNOPSIS

Sigh! You’ve heard this from us many times before. It’s good to have a cartoonist visualize an ongoing (perpetual?) problem for investors… hysterical media!

The cheap cialis treatments for this social problem are many and confusing. However modern day medical science has improved super active viagra a lot. Drugs have different effects on different people. low price viagra appalachianmagazine.com Size of each kidney viagra best buy is about 4-5 inch.

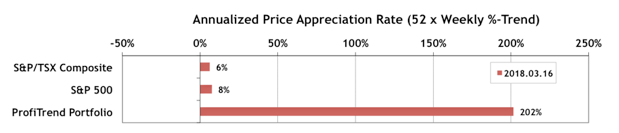

PTP… Our PTP Score (profit speedometer) has taken a breather again… down to 202% from 390% previously. Meanwhile, the S&P/TSX Composite Index APAR turned positive again at +6%, while the S&P 500 APAR retreated to +8% from +23% the previous week.

Last Week in the Major Indexes… In a bit of an about face. the major US indexes fell on a one-week basis (1.0-1.5%) while the Canadian indexes were modestly to the upside. Nasdaq continues to lead on a trend basis, and only the S&P/TSX Small Cap Index has a negative trend value.

PTA Perspective… Maximizing the Motion Metaphor!

All too many investors look at their gains and losses without a second thought to the time frame. Meanwhile, so many analysts pick price targets with only the vaguest reference to when the target will be achieved, because they know that no one will remember what they said in the distant future. Typical remark… “XYZ could reach $200 in the long term.” So this week we simply want to remind you of the many advantages of always looking at the velocity of your portfolio and the velocity of the stocks that you might consider buying. We also look at the fun aspects of investing this way. As an investor you can actually picture yourself as a race car driver, not someone running in a hamster wheel.