SYNOPSIS

It’s not that the stock markets are always a roller coaster ride. It’s just that a plunge like last week’s after an amazing run up earlier in January can be a little unnerving. After all we tend to remember shocks to the system, better than mundane steady gains. And we experience and remember losses more than similar-sized profits. Don’t panic. Many analysts have been predicting (or hoping for?) a “healthy correction”, before the markets can take another run upward.

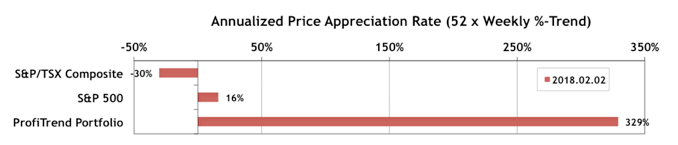

PTP… Naturally, we took losses last week just like everyone else. We had some sell signals early in the week, and acted on them. Our ProfiTrend Portfolio APAR (annualized price appreciation rate) was chopped in half over the week, but, hey, compare our performance with the S&P 500 stocks, now at 16% from 66% a week earlier, and the S&P/TSX Composite stocks APAR, a -30% now from +14% last time.

Last Week in the Major Indexes… It was negative signs across the board for the major North American indexes, with the exception of the unchanged Russell 2000.

PTA Perspective… CSE – The Exchange for Entrepreneurs

Hidden in the shadows behind the Toronto Stock Exchange and the TSX Venture Exchange is another small independent competitor called the Canadian Securities Exchange. It may be small but its growing rapidly. Since it’s largely ignored by the business media, we introduced it to you back in a December 2016 edition of TrendWatch Weekly. Billing itself as the “Exchange for Entrepreneurs”, it mainly provides a trading home for startup companies seeking public capital. In the world of large, medium and small caps, most of these companies would be considered micro-caps. Nonetheless, for investors willing to take a chance on speculative ventures, the CSE deserves more of your attention. We extend our coverage of the CSE this week, noting the progress that has been made in the past year or so.