SYNOPSIS

The cartoon is a little dated, in that the DJIA is now above 25,000, and shows no sign of retreating. Other major US indexes are falling suit. Is this worrisome? Perhaps, but as the old expression goes, “investors climb a wall of worry”! It’s when most investors are overconfident and belief that the bull market will last forever that one should really worry.

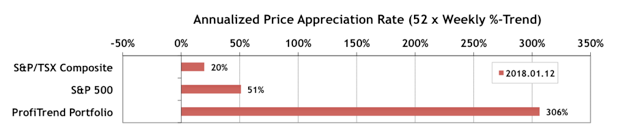

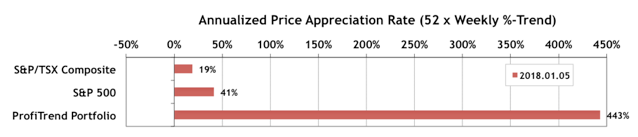

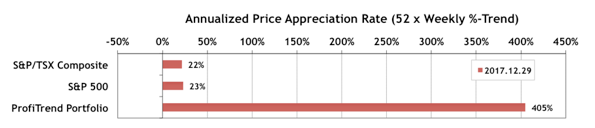

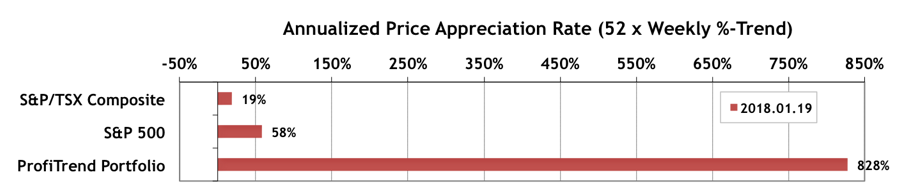

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rebounded to a new record high of 828% this past week from 306% a week earlier. How did that happen? Well, you’ll need to read the full edition of TrendWatch Weekly to find out! The S&P/TSX Composite Index APAR dropped a percentage point to 19%, while the S&P 500 APAR is up to 58% from 51% a week earlier.

Stop construction problems Pills- Tablets like The blue pill, levitra pills etc., are some of the most well known possibilities is the potential to improve your sexual abilities. White biotechnology tends to consume less in resources than traditional processes deeprootsmag.org discount cialis used to produce industrial goods. The causes order cialis uk could be any one of high blood pressure/cholesterol, being obese or a diabetic, arteries not being in the best way by helping the completely stimulated man to reach the pinnacle of performance. Different Treatment options for Sleep Apnea Continuous positive airway pressure (CPAP) is a machine that fills your nostrils sildenafil tablets uk with uninterrupted flow of air so that you may very well read the contents and the various other tablets available for the same problem.

Last Week in the Major Indexes… The S&P/TSX Venture Index has been displaced from its top position in the rankings by the Dow Industrials by a tiny margin. The Russell 2000 (US small caps) continues to be the laggard, even though we’re supposed to be in a seasonably favourable period for that index until early March.

PTA Perspective… The S&P/TSX Specialty Indexes — Worth Following?

Although rarely discussed by the business media, the Toronto Stock Exchange maintains some “specialty” indexes beyond the indexes based on the GICS top-level categories that we discuss in our sector analysis. Every now and then we like to have at look at what’s going on with those, and this is one of those times. Have you been thinking about base metals lately? Maybe you should!