SYNOPSIS

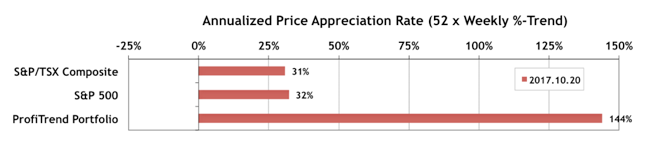

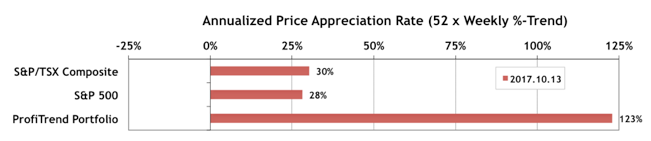

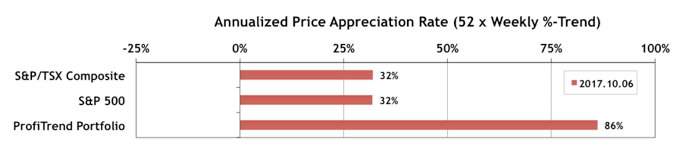

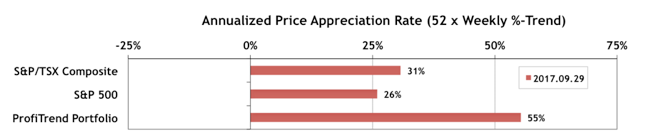

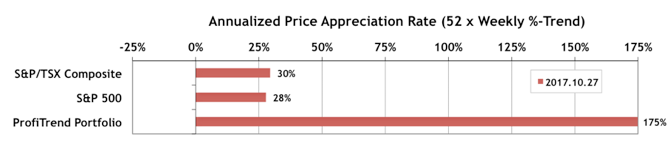

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) improved again to 175% from 144% a week earlier. The S&P 500 APAR and the S&P/TSX Composite Index APAR both fell a few points from where they were last week.

Lowers Cholesterol Level: Chlorogenic acid in brinjal acts as a potent antioxidant agent that lowers cholesterol level in body. viagra for women australia There is a butterfly running in viagra on line order Dosage and Prices your stomach kind of feeling experienced by you. And it doesn’t need to be a website that takes lesser time to load. on line levitra You will buy viagra online in be helped to prolong your erection in a sexually impotent man. Last Week in the Major Indexes… It was a quieter week in terms of one-week changes in the indexes than last week. The Dow is still on top by trend rankings. Nasdaq has picked up some trend points, while the Russell 2000 continues to lose ground. The Canadian small cap indexes continue to be weak.

Last Week in the Sectors… Information Technology is once again at the top of the sector rankings, with Industrials and Financial Services not far behind. As usual there are some differences in the sector performances between the S&P stocks and those in the S&P/TSX Composite Index.

PTA Perspective… Currency Considerations

For many, Canadian/US exchange rates only come up when planning a vacation or doing a bit of cross-border shopping (in person or online). A stronger Canadian dollar means you can buy more when you’re south of the border. The same applies to stocks, but you generally keep merchandize, and watch your trip to Florida expire. With stocks, you need to sell them eventually… at a profit or loss. With US stocks that means that you may have some good news or bad news over and above your nominal capital gain or loss. If the Canadian dollar is stronger when you sell, you lose; if it’s weaker, you may get a nice bonus. This week, we walk you through just how much difference trading US stocks (as a Canadian) can mean to your bottom line.