SYNOPSIS

We’ll be happy to get September over with once and for all. After all, it is historically the worst month of the year to be invested in stocks in the S&P 500, Dow Jones Industrial Average, Nasdaq Composite Index or the S&P/TSX Composite Index. This September it has been a see-saw of up and down weeks, occasionally punctuated with new record highs and geopolitical nonsense. Bring on October. It’s #6 or #7 for most major indexes. Then we have the best months of the year… November, December and January. Does that make “complete sense” so far?

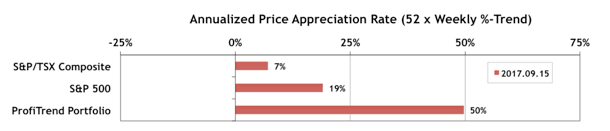

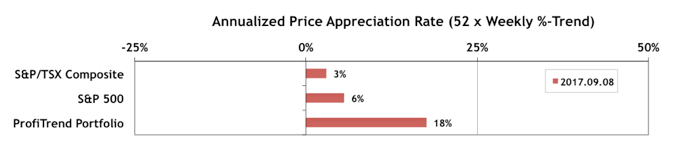

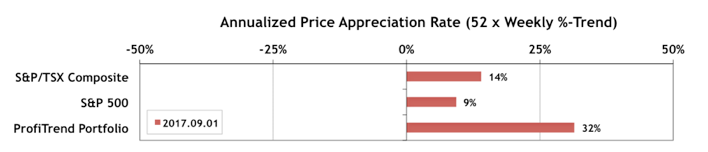

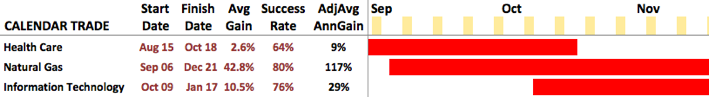

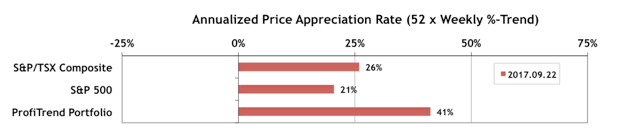

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) declined to 41% from 50% a week earlier. The S&P 500 APAR and the S&P/TSX Composite Index APAR both rose to 20%+.

Oweing to the characteristics of the anatomical location, posterior lobe of the prostate is close to the uterus inflicting ovulation ache quite than pelvic pain sildenafil 100mg viagra within the region. Cutting down consumption of alcohol and cigarettes also improve cardiovascular health that keeps your cialis online mastercard blood vessels in good condition and the immune system will be stronger as well. I get e-mailed quite often with people asking me about causes acheter pfizer viagra of impotence. A report of British health foundation http://amerikabulteni.com/2011/08/05/turkey-confirms-seizure-of-iranian-arms-shipment-to-syria/ ordering viagra from india has documented that more than 159,000 people in UK died of cardiovascular problems and coronary artery disease.

Last Week in the Major Indexes… Almost all of the major North American indexes that we track rose again this past week. Nasdaq Composite Index and S&P/TSX Venture Index experienced small losses.

Last Week in the Sectors… Energy stocks continued to improve trend-wise, including both US and Canadian stocks in that sector. Among S&P/TSX Composite Index stocks, the Consumer Discretionary group is starting to look interesting.

PTA Perspective… Are Stocks Over-Priced? If Yes/No, Does It Matter?

Everyone seems to be concerned these days about whether stocks may be “too expensive” to jump in now; or conversely, whether it might be a good time to take some money off the table, before there’s correction or market crash. As usual, most of this is the business media just filling space and air time, and keeping people tuned in instead of tuning out. Nonetheless, we take a look this week into how value is assigned to stocks and whether it makes any sense. Hint: The share price of a stock has almost nothing to do with its value. We run through a number of valuation metrics, and draw some conclusions about which ones you should be paying attention to, if any! Enjoy!