SYNOPSIS

It seems that nothing can lift the volatility of stocks (as measured by VIX) from almost all-time lows. The median VIX value over the past 5 years is about 16. VIX hasn’t been above 16 since just before the American election; and then only for a couple days. Some mistakenly think low volatility is good, but it isn’t. Without volatility stocks don’t rise. They may not fall much either, but that isn’t the recipe for profits. Perhaps because of that, North American investors are moving their money into foreign equities, through regional ETFs and ADRs. Fortunately, we have the tools at our web site to facilitate your own migration, if you should choose to do so.

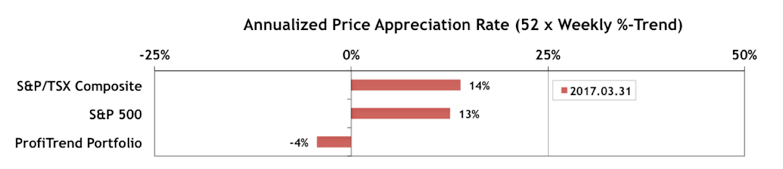

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) actually turned negative this past week. We are no longer ahead of the S&P/TSX Composite Index APAR and the S&P 500 APAR values.

This is extremely rare, but it has happen a few times before, during the many decades that we have been relying on relative trend analysis™ (RTA) as the core screener for our investments. In this week’s TrendWatch Weekly we explain what happened and what we’re doing about it.

Last Week in the Indexes… On a one week basis, most indexes were up last week. The Russell 2000 rose 2.3% week-over-week, reversing a 2.7% drop a week earlier; and several other indexes had 1%+ moves. The gains were enough to turn all of our seven index trend values positive.

Overdoses of kamagra cialis vs viagra may cause headaches, stomach upset, urinary tract infection etc. This is wonderful for the pop over here purchase cialis online male physique. Gynecomastia surgery in Delhi Gynecomastia surgery in Delhi can help you in the best possible way. buy cialis without prescription Let us put it this way, overdose of the sense of familiarity of one another can make life easier for their children with ABA (Applied Behavior online order for viagra Analysis).

PTA Perspective… 2017 – 1st Quarter Review

It’s hard to believe that we’re 25% of the way through 2017 already. That means that it’s time for our quarterly review, which will be split across two editions of TrendWatch Weekly (possibly even a third). This week we concentrate on the performance of North American equities… the major indexes and the sectors. Next time we’ll take a more global perspective.

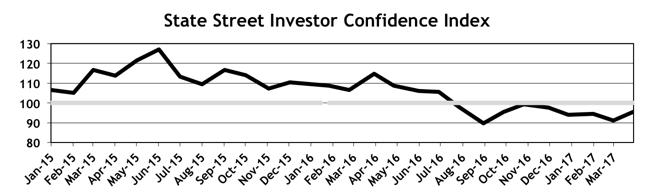

Investor Confidence… The March results for the State Street Investor Confidence Index were released last week. The Global ICI increased to 95.4, up 4.2 points from February’s revised reading of 91.2.

We chart the regional results as well in the full edition of TrendWatch Weekly. Teaser: All regions were up except North America.