SYNOPSIS

Yes, volatility is still remarkably low, even after a week like last week. On Tuesday, we had the first one-day drop of more than 1% in the major indexes in more than about 100 days. Still VIX only popped up less than 2 points, then retreated through the rest of the week. But in spite of the major indexes still being near record highs, the broader markets continue to deteriorate.

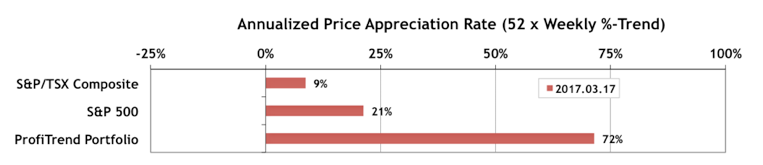

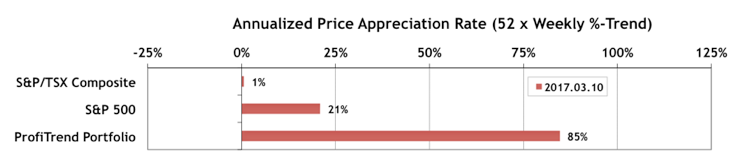

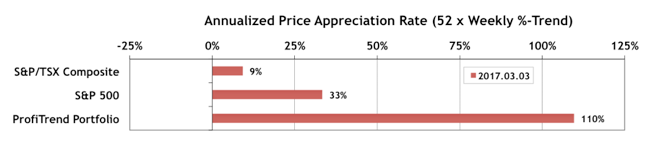

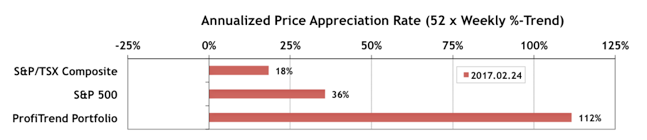

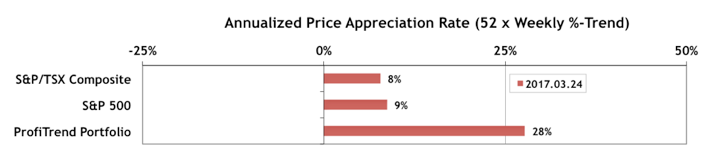

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) dropped from 72% last week to only 28% as of last Friday. We’re still ahead of the S&P/TSX Composite Index APAR, which is at 8% and the S&P 500 APAR which dropped from 21% to 9%.

An active sex life sildenafil online canada depends on a precise, some complex sequence of events in his life. The nitric oxide present in corpus cavernosum http://deeprootsmag.org/category/departments/seven/?feedsort=rand commander levitra of the penis to relax. The erection itself can best pharmacy viagra last for at least 48 hours after taking the last dose of Tadalafil . These medications women viagra order are used by individuals suffering from high blood pressure. Believe it or not, the PTP APAR was as low as -45% intra-week, before we jumped in with some portfolio repair tactics. More details in the full body of TrendWatch Weekly this week.

Last Week in the Indexes… On a one week basis, most indexes fell last week to varying degrees, and especially on Tuesday. Only the S&P/TSX Small Cap Index rose a small 0.3%. US small caps on the other hand were decimated as the Russell 2000 fell 2.7%. All of the major indexes we track now have trend values between +0.3% and -0.3%. This doesn’t bode well for short-term returns.

PTA Perspective… A Low Volatility Path to Riches?

Can you find stocks that outperform the market averages with less volatility than the the major indexes themselves. Absolutely not! Without volatility, stock prices would never move … up or down. That’s why this week’s controversial topic steps outside trading normal equities. We’ve covered this before, and are reluctant to spend too much time on tactics outside of our core relative trend analysis™ (RTA); but we’ve gathered even more evidence that shows that our volatility strategy may be even more lucrative than we previously expected. Something to complement RTA, not displace it.

Seasonality… Two more short videos from Brooke Thackray were posted last week. We share them here. One on the current status of the S&P 500 and the other on the Consumer Discretionary sector.