SYNOPSIS

Ho hum! More index all time highs and no volatility. The only problem is that equities are still trading in a narrow range in spite of the upward bias.

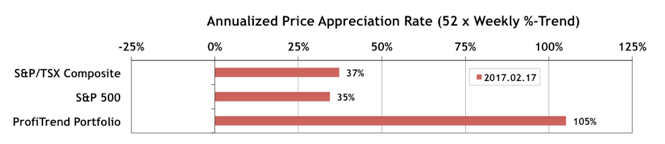

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) fell just slightly to 105% last week. We’re still well ahead of the S&P/TSX Composite Index APAR at 37%; and the S&P 500 APAR at 35%. There were three additions to the PTP last week, and one position was closed.

Last Week in the Indexes… On a one week basis, all indexes were up last week to varying degrees. On a trend basis the leaders continue to be the S&P/TSX Venture Index, S&P/TSX Small Cap Index and Nasdaq Composite Index.

PTA Perspective… More on the Small Cap Advantage

Several weeks ago we discussed the notion that large cap and small cap stocks can go in and out of favour from time to time; and one could build a simple investment strategy based on switching between a small cap ETF and a large cap ETF based on prevailing trends. This week we approach the topic from the perspective of seasonality. Brooke Thackray has discovered the best time frame of the year to be invested in small caps… and the worse time. We’ll take you through the numbers.