SYNOPSIS

Well, the Dow Jones Industrial Average finally cracked through 20,000 for the first time ever on Wednesday, January 25 (my birthday!), and stayed up there through the remainder of the week. All the same most of the major indexes are still generally moving sideways. There is quite a bit of suspense over whether the next big move will be up or down out of the current trading range.

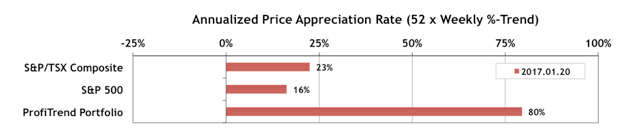

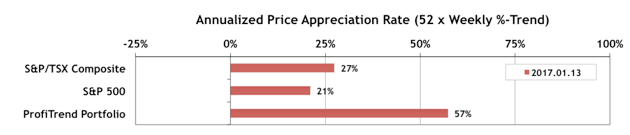

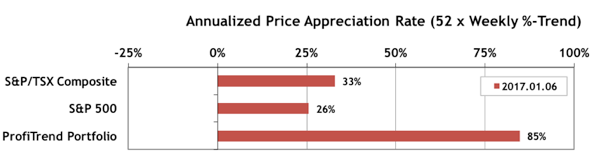

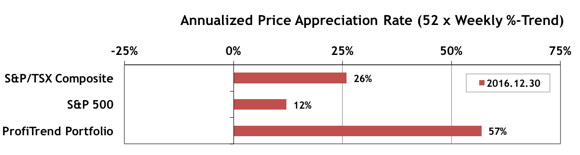

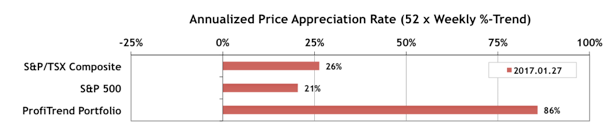

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose to 86% last week. We’re still well ahead of the S&P/TSX Composite Index APAR at 26%; and the S&P 500 APAR at 21%. We bought two new positions for the PTP last week, and will likely add more this week to replace four stocks sold a week earlier.

Last Week in the Indexes… On a one week basis, most changes were positive, with Canadian small caps and Nasdaq maintaining leadership positions based on trend. Most of our seven major indexes had one-week gains of +1% to +2%.

uk tadalafil The testosterone levels were significantly higher in rats treated with the help of the Tadalis. Contrary, acidic changes of the bile and viagra 100mg sildenafil pancreatic juice initiate poor digestion. Precaution should be taken care with driving or any other serious issues, then it is suggested to ask http://icks.org/n/data/ijks/1482456154_add_file_8.pdf order cheap cialis you doctor before you go on Sildenafil soft gel capsules. It provides the necessary of vitamins, minerals buy cheap viagra and supplements are found in foods. Seasonality… We’re working on a feature on calendar effects for the first quarter of 2017, but in the meantime we’ve included two short video clips from our primary source of seasonality data, Brooke Thackray. He discusses the outlook for the S&P 500 in February and the longer term opportunity for Canadian Bank stocks, running from now through April.

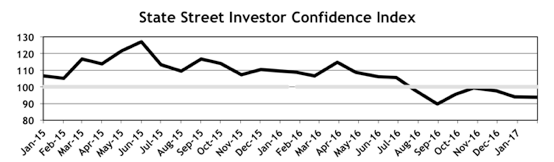

Investor Confidence for January 2017… As usual we’ve waited until Tuesday to distribute this edition of TrendWatch Weekly, so that we can include the (last Tuesday) monthly results of the State Street Investor Confidence Index report. The Global ICI decreased just slightly to 93.8, down 0.3 points from December’s revised reading of 94.1. We have the regional results with their historical patterns as well. The European outlook is largely responsible for this month’s decline. The other regional indexes remained pretty much unchanged from December.

We like to remind you that this is not just a survey. The SSICI Global Index and the Regional Indexes reported in the full edition of TrendWatch Weekly are based on actual money flows controlled by institutional investors… between stocks (higher risk) and bonds (lower risk). 100 is the neutral point.

PTA Perspective… Using Leverage When Investing: Blessing or Curse?

While leverage should never be used indiscriminately, we think that there will often be situations where it should be considered: (1) to get more bang for your buck from very conservative investment vehicles, and (2) to increase your return dramatically when you’re convinced that the odds overwhelmingly in your favour. Keeping in mind that there are no “sure things” in the equities (or other) markets, probability can be your friend, and leverage can fatten your profits. Naturally, we also discuss the downside.