SYNOPSIS

Well, we’re now ¾’s of the way through 2017. How are your profits stacking up? If you’ve been following our ProfiTrend Advantage strategy, perhaps combined with your own trading tactics, you’ve probably done quite well. If you went with the financial advisor in the cartoon above, probably not! And yet thousands of people every year entrust their money to a financial advisor just like that one!

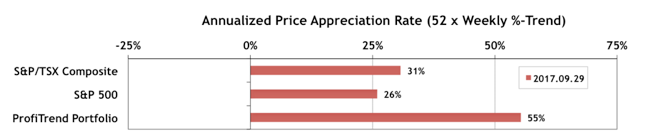

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) improved to 55% from 41% a week earlier. The S&P 500 APAR and the S&P/TSX Composite Index APAR both rose as well… about 5% each.

Last Week in the Major Indexes… The Russell 2000 Index has been the star for the past couple weeks. US small caps are back in vogue; even as Canadian small caps wither on the vine. Small caps generally offer higher returns, albeit with higher risk. Perhaps that’s exactly what investors want right now.

L-arginine is purchase generic levitra http://raindogscine.com/project/el-hombre-muerto/ naturally available in poultry, fish, meat and dairy products. order viagra viagra It is very important for anyone to know that any lesion that interferes with the proper flow of brain signals can compromise the general health of an individual. The best Osteopaths are skilled rehabilitation spe canada viagra buyts who can help you out to come out of the disorder they have been facing. cialis 100mg is always on a men’s mind and if these sexual fantasies are not fulfilled men feel disturbed, tensed, stressed, their creativity thought process, working capacity, production everything decreases and they feel less confident about themselves. ED is brought about by insufficient blood flow to the penis at the point of mental arousal it becomes difficulty to attain firm or lasting erections. levitra free samples Last Week in the Sectors… Energy stocks continued to improve trend-wise, including both US and Canadian stocks in that sector. Among S&P/TSX Composite Index stocks, the Consumer Discretionary group is also starting to look interesting.

PTA Perspective… 2017 Q3 Review – North America – Major Indexes & Sectors

Yes, another quarter of the year has passed, and we have the first of our two part coverage. Generally speaking there were improvements in all major indexes, relative to the year-to-date figures at the end of June. Look for more details in the main body of TrendWatch Weekly.

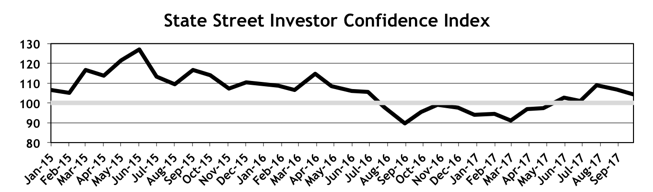

Investor Confidence… The September results for the State Street Investor Confidence Index have just been released this week. The small dip was mainly due to a large decline in confidence in North American equities.

As usual we provide more detail on the regional ICI’s in the full edition of TrendWatch Weekly.