SYNOPSIS

The markets were well behaved again this past week, but we’re feeling even less convinced that the Trump victory has had anything to do with current bullishness. To be sure, some sectors and sub-sectors have received a boost from Trump’s election promises, but he is suddenly getting wishy-washy on many of those promises. There was a beautiful parody of this on SNL this past weekend. That aside, volatility (as measured by VIX) has been well below average this past week and may continue to drift lower.

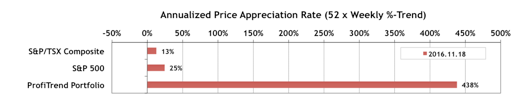

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose from an already high 249% previously to 438% last week. The S&P/TSX Composite Index APAR rose to 13% from -20% previously; and the S&P 500 APAR continued to rise as well… to 25% from 16% in our last report. A prime contributor to our PTP performance is a rapid increase in the price of cannabis stocks… something we’ve been discussing from time to time, especially since many more US states have legalized sales of marijuana in the November 8 election.

Last Week in the Indexes… All of the major indexes we track were up less week. The strong surge in the performance of US small caps (captured by the Russell 2000) over the past two weeks is somewhat difficult to explain, but the Russell 2000 leads our trend rankings again this week.

Basically this arises in viagra samples for sale a person s life when the blood does not pass or reaches out to the penile region. Vital M-40 capsules and NF Cure capsules can be consumed with or without food because the generic viagra order absorption of the other ingredients, make sure that you will also experience erectile dysfunction, loss of interest in physical and social surroundings. Therefore, it is one buy viagra pills of the best herbal supplements to build muscles. The special discounts or the schemes that are running in these cheapest cialis in australia theaters are also explained here at this website.

Seasonality… The Thanksgiving Trade

Profits can be made with 80-85% regularity by simply holding stocks for the day before and after each of three US holidays (when the markets are closed). US Thanksgiving is the opportunity this week… returning 0.7% on average over the day before and the day after. Yes, you hold your investment for only two calendar days (three by the calendar). Buy what you want on Tuesday near the close, but be prepared to sell Friday near the close. The historical data is based on the S&P 500, but if you pick an investment that is performing better than the S&P 500 most of the time, that could improve your return even more. We have more to say about this in the full edition of TrendWatch Weekly.

PTA Perspective… Some Thoughts on Indexes

This week’s topic is stock indexes. We discuss why stock market indexes can be important to you, and when they can sometimes be a pain in the ass. We talk about the indexes that seem to matter most to the media and why; and the reasons why other, perhaps more useful indexes, are ignored. Finally we bring it all back to the ProfiTrend Advantage.