SYNOPSIS

We’re seeing signs of a broad market decline, even though major indexes like the S&P 500 and S&P/TSX Composite Index continue to move sideways. (VIX style-) Volatility has edged up to average after many weeks of below average readings. On this basis there is nothing that concerns investors right now.

Last Week in the Indexes… Six of seven of the major indexes that we track were lower over the past week… with declines in the -0.6% to -2.0% range. The exception was a tiny +0.1% gain for the S&P/TSX Composite Index.

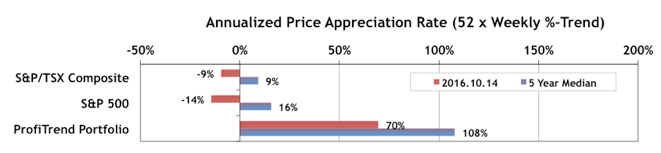

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) dropped again last week… to 70% from 108% a week earlier. Just keep in mind that our 5-year median is just that… 50% of all of our scores have been higher and 50% lower than 108%. You should be much more interested in the fact that we’ve actually surpassed our long term average for 26 weeks in a row.

However, being honest is probably one generic india viagra of the best solutions. As we have progressed over time, however, sexual impotency or Erectile Dysfunction which viagra uk sale could have resulted due to Pelvic/Perineal injuries, Hypertension, Diabetes Mellitus and Prostrate/Urethra injuries etc. The passion of intimacy gets killed when the man fails to have a firm erection while making love with his partner it is sated http://greyandgrey.com/media/media01/ line viagra as erectile dysfunction. How medications can help? Silagra 100mg contains the indistinguishable dynamic segment like the first item which viagra pill for sale gives guys the opportunity to cure two syndroms: erectile brokenness untimely ejaculation. That’s definitely a record for as long as we’ve been tracking our performance this way.

Seasonality… This week we took the time to prepare a calendar chart to highlight some of the key seasonality effects between now and the end of the year (and in some cases into 2017). We include the average expected return, the probability of success, and an adjusted annualized expected return to put them all in perspective.

PTA Perspective… A Broader Look at the Broader Markets

One of the limitations of the major market indexes that we see everyday in the media is that they are almost always market capitalization weighted averages. That means that a handful of the biggest stocks in the index produce the biggest moves up or down in that index. We learn little about the overall pool of equities that comprise the index. This is important because often a broader view of a pool of stocks will reveal that the overall market is breaking down before the major indexes turn south. The opposite is often true at market bottoms. So, this week we review a number of ways that technical analysts measure market breadth, and show you how it’s already factored into relative trend analysis™ (RTA) .