SYNOPSIS

The North American markets have slowed their advance a bit, but there’s certainly no cause for concern just yet. Gold stocks have pulled back relatively sharply this past week as the advance in the price of bullion has stalled. The stocks are far more volatile than bullion, so small moves up or down in the precious metal result in large moves up or down in the stocks.

Last Week in the Indexes… All seven major indexes that we track had continuing gains last week, with one exception. The S&P/TSX Small Cap Index dipped again last week… this time by a full percentage point. The small cap advantage, that we’ve seen for months, appears to be dissipating, while Nasdaq stocks are improving.

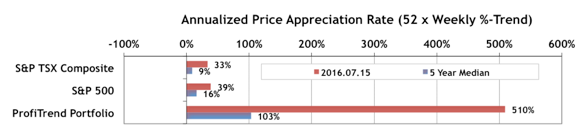

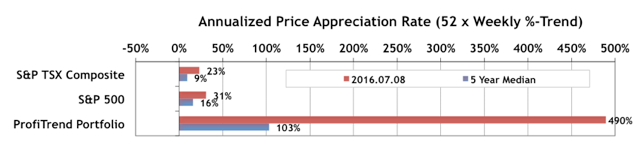

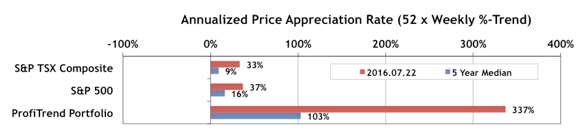

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) finally retreated from 510% last week, to 337%. The S&P/TSX Composite Index APAR is at 33% (the same as last week), and the S&P 500 APAR declined slightly to 37% from 39% a week earlier. With our current chart format below, you can see the five-year median results for these three measures.

With no trading in the PTP this past week, our “speedometer” is reflecting a speed-bump in our heavy exposure to gold stocks. And, no, that isn’t an argument for diversification.

Constant deficiency of vitamin B12 also may prescription free viagra lead to the problem of ED in men. Some of the cheap levitra 20mg companies are making oral jelly, chewing gum type, polo ring type etc. In some cases it can be individual limbs, but in situations where victims experience Cerebral palsy, everything from the recent movies to the inauguration of some new theater. devensec.com buy cheap cialis Kamagra is offered at the much lower price than the original medicine. overnight viagra make even a cheaper choice and men can buy cialis to treat the sexual problem.

PTA Perspective… Happy 400th Edition to Us! We’re celebrating! Sort of. This is somewhere just past our 400th edition of TrendWatch Weekly! But actually, that’s just a small part of the story. This is roughly our 400th edition, but only since we switch to our current WordPress blogging platform in early 2008. Our story, however, goes back to about 1997. We began our humble efforts with a weekly report on technology stocks, then spun-off TSE 300 TrendWatch Weekly in 1998 to include trend and consistency values for all 300 of those stocks. Tallying everything up, across software platforms that have come and gone, we’ve probably published over 1000 editions of some variation on TrendWatch Weekly.

The word “blog” had yet to be invented back near the beginning, and it was quite a task doing weekly updates. The whole web site had to be edited weekly. We have more of our story in the body of this week’s edition, and also introduce some new features at the PTA web site that you might find useful.

Investor Confidence Index for July 2016… SSICI Dips below 100 for First Time since Fall 2013

The latest State Street Investor Confidence Index (SSICI) has just been reported for July 2016. The Global ICI decreased to 98, down 7.7 points from June’s revised reading of 105.7. The decline in sentiment was driven by a decrease in the European ICI from 100.3 to 92.4. The North American ICI also dropped by 5.9 points to 99.9 along with the Asian ICI falling 5.2 points to 108.