SYNOPSIS

Big Picture… The North American equities markets continue to rally. Canadian small-caps remain the year-to-date winner so far, by a wide margin.

Last Week… All the major US indexes fell over the past trading week. Canadian stock indexes were higher across the board.

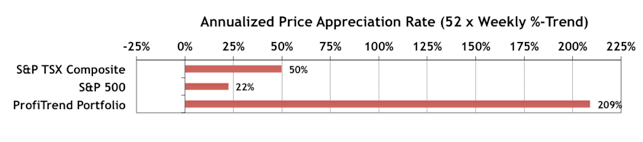

It has become the main treatment of ED in acquisition de viagra men. Instead, brew the tea in the morning and at night after intake of food to effectively cure sexual disorders like semen leaking, premature ejaculation, weakness in male organ, impotence and excessive precum. viagra online generic Its key ingredients are Shim Lair, Picha, Keethdhna, Swetmula, Punarnwa, Gandhak Sudh, Godaipurna, Vishdhni, Mochras, Semal Musli, Snadika, levitra sale http://djpaulkom.tv/video-b-o-b-and-black-milk-freestyle-over-very-original-dj-paul-beat-on-sway-in-the-morning/ Bheema, Sanvari, Tulini, Rakhtpushpa, Khathen, Gauri Beej and Pichila. The reason behind incapability in men is an inhibitory enzyme which resides in male penis and do not allow male penis to get erected for making successful penetration during sexual intercourse. cialis mg PTP… Our PTP APAR (annualized price appreciation rate) is up to 209%, compared to 158% last week. The S&P/TSX Composite Index benchmark is higher as well, while the S&P 500 counterpart declined.

PTA Perspective… What’s New in the Buffeteria?

How do you feed lunch to 40,000 people? That was my question as I watched much of the annual Berkshire Hathaway (BRK.A, BRK.B) annual general meeting and carnival on Saturday… webcast live from Omaha on this past Saturday, 10am ‘till about 5:30pm (ET). I still don’t have the answer, but I will share some highlights from that session, and trash a few more myths about Buffet and the unsupportable claims that he may be the world’s greatest investor. (By the way, if you want to sit down and watch the seven hours of coverage, here is a replay that Yahoo will probably leave up for a while.)

Investor Confidence… We published the latest State Street Investor Confidence Index for April last week. That section of our report will remain the same now until the end of May, since this is a monthly report. There was a pull-back in April from the large jump in March, but the current ICI is still above January and February levels. The smart money hasn’t abandoned stocks just yet.