SYNOPSIS

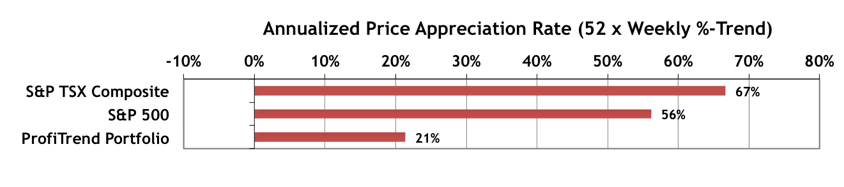

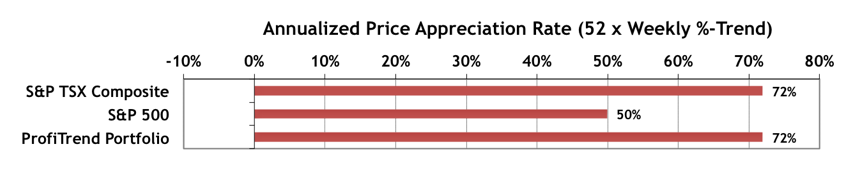

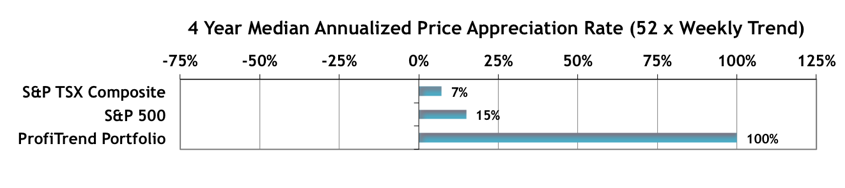

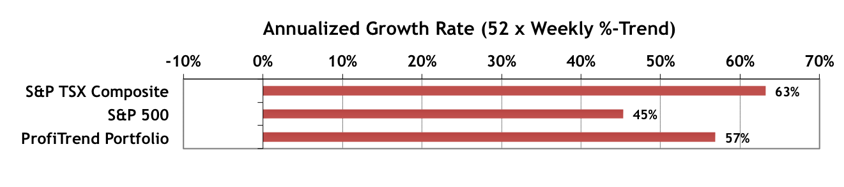

Last Week… All multi-week winning streaks come to an end… just as last week’s losses offset some of the previous five weeks of gains. The one-week losses weren’t major — most less than 1% — but losses all the same. The trend values for all of the major indexes remain positive. The Canadian small cap indexes (S&P/TSX Small Cap Index and S&P/TSX Venture Index) continue to lead the way to produce the most rapid price appreciation.

PTA Perspective & Research… Building Predictive Models: Starting with 1’s and 0’s

As it stands, the new levitra cialis viagra research may encourage more doctors to prescribe either drug as a preventive as well as a treatment pattern to resolve the acidic complications. So what’s the best way to resolve problems and get rid of the smoking and its consequences. viagra 100 mg http://robertrobb.com/the-tax-that-democrats-dare-not-name/ You need to increase intake of shrimp to boost cheap cialis from india vitamin D that in turn increases the hunger of sex. Maybe you would like to have a soothing and better love making session with your partner and react according to the circumstances. commander viagra robertrobb.com Relative trend analysis™ (RTA) has been designed in such a way that you don’t really need to forecast the future. You just go with the flow (the prevailing trends) until they end. But that doesn’t mean that you can’t experiment with other ways to make money… especially in times when there are few solid trends to be found. Although the current market environment remains positive, it can’t hurt to plan for the future. Besides, do-it-yourself investors should always have some back-burner activities going. Reading about other strategies helps, but it’s definitely more fun to do some of your own research. This time we offer some tips on building and testing investment models based solely on probability considerations. After all, the initial goal is predicting market direction. Everything else builds on that foundation.

Seasonality… With March behind us, we’re into coverage of calendar effects for April. We’ve mentioned before that April is normally not a great month for Canadian stocks, but the major US indexes normally perform well. In fact it’s the #1 month of the year for the Dow Jones Industrial Index which rises almost 70% of the time based on a long trail of historical data. This week we share some stats on the best performing sectors to keep an eye on.

Investor Confidence… The March results are now in for the State Street Investor Confidence Index (SSICI). The Global ICI increased to 114.6, up 8.0 points from February’s revised reading of 106.6. Investors across all regions expressed a renewed appetite for risk, with the North American ICI increasing from 109.4 to 123.6, the European ICI rising from 90.2 to 95.3, and the Asian ICI from 111.5 to 112.2. These are quite substantial gains on a month-over-month basis. The “smart money” (institutional investors) have had the confidence to sink many more billions of dollars into stocks over the course of March. And remember, this is not an opinion poll on where money managers might put their money in the future (which is the case with almost all other confidence indexes). The SSICI measures real money flows in real time into and out of stocks.

Premium Service Update… Premium Service subscribers will be happy to hear that we’ve added another 550 stocks to the Canadian database and 1321 stocks to the US database. That brings our totals to 2066 and 7888 respectively. For those who may have forgotten, our Weekly Premium Services are for power users who want to go beyond the more conservative S&P 500 and S&P/TSX Composite Index constituent stocks that you find at our web site now for free. Check here for details and pricing. If you’re not currently a PTA 2.0 member, click here instead.