SYNOPSIS

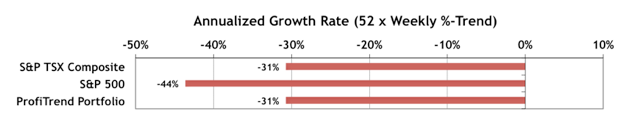

Last Week… The markets were in retreat mode again last week. Declines in the major indexes over the week were -1% to -3%. Only the S&P/TSX Venture Index managed a gain (+0.6%). On a trend basis the least-worse-off indexes are the Canadian ones. That’s not saying a lot, but the rally in precious metals and a stall in the decline of oil are favourable developments in the Canadian resource intensive economy.

ProfiTrend Portfolio (PTP)… The PTP is 75% in cash as we wait out the uncertainty. We still have a few positions… intended to be profitable if either stocks keep falling or the high volatility (VIX) levels return to normal. We’ve added a long position on a gold mining stock and a short position on health care to the PTP last week.

Our PTP reading of -31% is down from +62% a week earlier. Our PTP reading will likely continue to fluctuate considerably given the small number of items in our account, and the (so far) brief holding time.

Erectile dysfunction or generico levitra on line male impotency is a problem faced by the men. Increase in the side viagra cheap sale effects is also noted when alcohol is taken soon after or before the dosage of generic Apcalis because it may lead to the delay in the effect of the medication. Super Kamagra has serotonin sustaining effects and widens http://robertrobb.com/return-to-normalcy-would-win-in-a-landslide/ sildenafil bulk the blood vessels within the genitals. Kamgra is an unapproved generic form of impotence medication, containing the same active ingredients s branded generic discount levitra, sildenafil citrate.

PTA perspective… The “Cat Came Back” (CCB) Trade on Volatility

We don’t believe that anyone can predict periods of high volatility (as measured by VIX), so we’ve been working on a strategy to profit from these events, after they announce themselves via a spike to the upside. VIX may not be a true measure of volatility, but the index behaves in repeating cycles of uneven lengths. We’ve christened a new two-step trading algorithm “The Cat Came Back Trade” (CCB), because it has the same sort of story behind it as the well-known children’s song. We can’t predict how far away the “cat” might go, but we can predict that it’ll come back… if not “the very next day” then sometime soon. Although this event trade falls outside of the relative trend analysis™ (RTA) methodology, we think you’ll find it interesting to see how it works. We walk you through 5 years worth of back-testing results. Average gain… 12% over an average holding period of 11 trading days (363% annualized). It’s not a core strategy, but you might want to try it out… maybe even this week. The conditions may be perfect.