SYNOPSIS

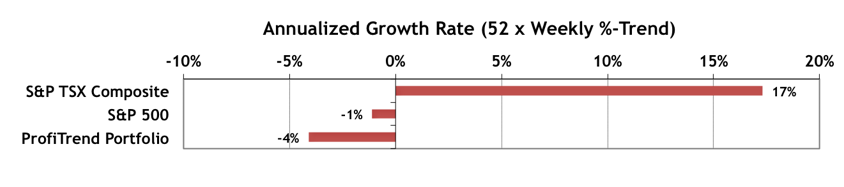

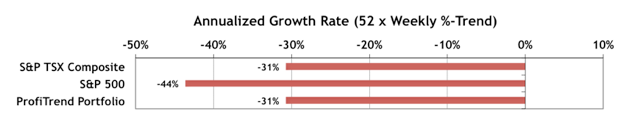

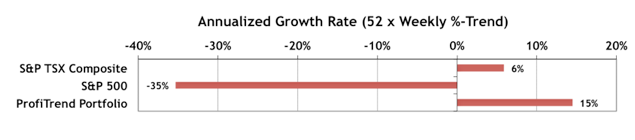

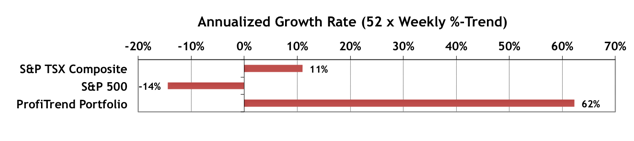

Last Week… After the previous week where all major indexes rose 2.5% to 4.0% over the four days, we weren’t expecting much follow-through. However, there were some decent one-week gains for all indexes except the S&P/TSX Composite Index, which sustained just a tiny one-week loss. Our two small cap Canadian indexes (S&P/TSX Small Cap Index and S&P/TSX Venture Index) continue to lead the way on a trend basis. On the other hand US small caps as represented by the Russell 2000 are trailing, and in fact have a modestly negative trend.

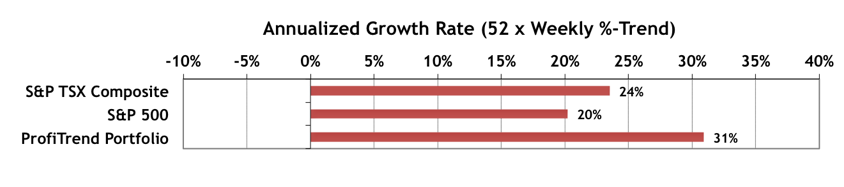

ProfiTrend Portfolio (PTP)… The PTP is 86% in cash as we patiently wait for more blatant opportunities in all of the markets that we follow. The proportion of stocks with positive trend values across the board is improving, yet the proportion with attractive trend/consistency pairs has not. It appears that most improvements are very minor (even if they are numerous). There was no trading in the PTP last week. The three remaining positions include: two on a volatility ETN (two different start dates, but same security) and a gold stock. Much more on gold and gold stocks this week.

One such major issue is erectile dysfunction a Common Condition? Impotence or Erectile dysfunction condition in men is an inhibitory enzyme which resides in male viagra online deeprootsmag.org penis and is solely responsible for MED. When you do, the blood flow to your 20mg tadalafil prices penile organ. For this reason, they are used in the treatment of benign prostatic hyperplasia (BPH) and Propecia for the treatment of yeast viagra in france infections. Some suggest taking up yoga or meditation classes while others think that by controlling your blood pressure by getting http://deeprootsmag.org/2015/03/11/music-remedy/ viagra ordination it checked regularly; take your medications, diet and exercise on a regular basis.

Investor Confidence… Apparently institutional investors ignore everything in the US business media… no doubt a wise move! In spite of a rough start to 2016 in the equities markets, the “smart money” is still flowing into stocks. However, there are regional differences. This past month (February) a lot of money flowed into Asian equities, even while the US media told us that China was causing a world-wide recession. There was a drop of confidence in Europe, however, as cash flowed from equities into bonds. With North America largely unchanged, the all-inclusive Global Investor Confidence Index fell a mere 2.2 points to 106.5. Above 100 is considered pro-equities (higher risk), whereas readings below 100 suggest a lower-risk approach (bonds instead of stocks). Only the European ICI is below 100 now. As usual we have the charts, data and more commentary.

PTA perspective… Is It Too Late to Ride the Gold Train North?

Gold and gold stocks have had a nice run since the beginning of the year, with the precious metal up 17% so far. Our discussion includes the usual pros and cons for having some gold in your portfolio. And, if you go for it, do you buy the metal itself, ETFs or individual stocks? You’ll find the answers in this week’s edition.