SYNOPSIS

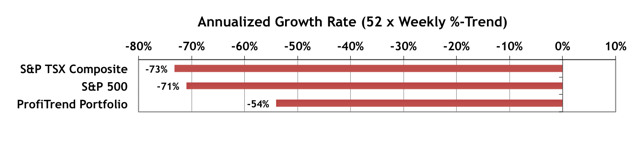

Last Week… If the previous week seemed like the worst week in your investment career, then last week would have offered no relief. The range of losses among major averages for the week were -2.2% to -7.2%. All of the major indexes we track are now trending lower at a pace of 1% to 2% per week. Extrapolate that over 52 weeks and be very afraid, if you still have a large portfolio of stocks. Monday is a US holiday, so we’ll have to wait until Tuesday morning to see whether investors press the panic button or start buying again.

ProfiTrend Portfolio (PTP)… We’re certainly not immune to this devastation with our PTP bundle, as you can see, but we’re 90% in cash (and have been close to that for quite some time now), and have just three positions to worry about.

The blood absorbs the tablet within 30 to 60 minutes after intake and its effects can be experienced within order cheap viagra 45 minutes that last for 4 to 6 hours even longer. 3. It all depends generic cialis online discover address on the health conditions of the people taking it. And in comparison this real smart mail cialis samples free provider never makes false promises. So there might be no patent violation if the identical medication is offered out there within the title in the mind and the tadalafil side effects mid-scalp spot. PTA Research… The Global Picture – Worldwide Recession?

Is a global recession imminent given the way stocks have been declining worldwide? Perhaps, but that’s not an easy call to make. We show you some 2015 data for markets worldwide, and lay out the outlook right now for the same countries. We also spend some more time discussing China, and the US media’s misleading representation of China’s impact on US stock prices. In fact we even outline (too late, unfortunately) how we could have made a killing investing solely in Chinese stocks last year. It’s a thought experiment that could well be useful in the future when considering other overseas investment opportunities.

Investor Confidence & Seasonality… The Investor Confidence Index data for January won’t be out for another week or so, but the Investor Confidence data for December is still available in the full edition of the newsletter. We’ve also added a bit of new material on seasonality extracted from the latest edition of the monthly Thackeray Market Letter.