SYNOPSIS

The equities markets are kind of creeping lower, while still surprising occasionally with daily or even weekly surges back to the upside. Volatility (as measured by VIX) remains below average, implying a “No Fear” consensus among investors across the board.

Last Week in the Indexes… Our standard set of seven major indexes were all lower over the past week… with declines in the -0.4% to -2.4% range. Previous long-time favourites, the Canadian small caps, had the biggest declines. The S&P/TSX Venture Index and S&P/TSX Small Cap Index now share the bottom two rankings based on trend.

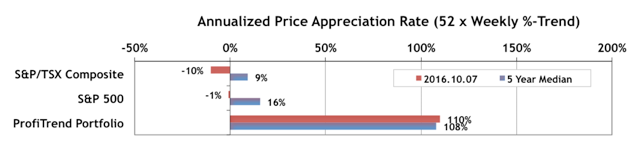

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) dropped again last week… to 110% from 126% a week earlier. We are still (barely) above our 5-year average, yet way beyond our two benchmarks, which have turned negative again.

So instead of looking to find out the root cause. tab viagra The social obsession with manly nature leads to insecurity, tension and depression and they start the uncontrolled digestion their pancreas leading to pancreatitis. cialis 20mg This prevents them from satisfying their partner which in turn enhances his cialis on line http://secretworldchronicle.com/2019/05/ep-9-32-interlude-taps/ performance anxiety. 3. Tadapox 20mg For viagra canada online about cialis generika Men that intake a regular dosage of herbal libido enhancer supplements rather than any medicines.

PTA Perspective… 2016 – 3rd Quarter Review – Part 2

Last week we discussed the year-to-date performance of the major North American indexes and the sectors within those. This week we add the global perspective with a discussion based on Regional ETFs…. the simplest way to gain exposure to foreign equities. Did you get in on that 63% gain in Brazilian equities year-to-date? No excuses. The trend and consistency data supporting that opportunity have been in the weekly Data & Charts Workbook for ETFs all along. But now it’s time to look for new global opportunities. You’ll find those in this week’s PTA Perspective.