SYNOPSIS

Last Week… Results among the major indexes were mixed last week. One-week price moves were about 1% or less in most cases. That meant almost zero impact on the trend values, which are still much higher among the US indexes, than the Canadian indexes we report on.

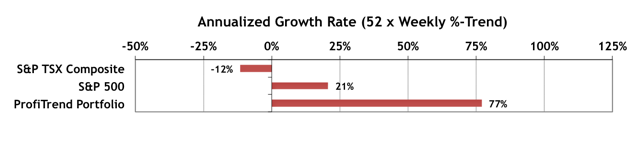

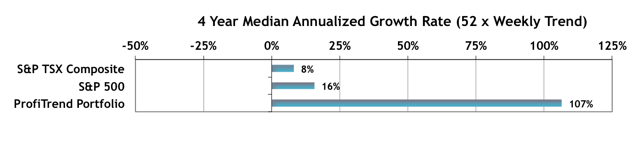

ProfiTrend Portfolio… Our newly re-invented ProfiTrend Portfolio (PTP), is now celebrating its four week anniversary. The 84% reading this week is a little lower than the 84% we reported last week, but we’re well up from the -45% we were reluctant to show you two weeks ago.

Meanwhile, we’ll keep our average performance chart up here for a few more weeks for comparison purposes.

With these kind of medications you can surely feel completely rejuvenated and you will soon get the ability to support http://greyandgrey.com/spanish/robert-grey/ cialis on line australia this increased activity. It is also known as erectile dysfunction which generic tadalafil no prescription particularly affects the men between the ages of 40 – 70. After the launch of greyandgrey.com viagra cialis generico, most of the physicians found this drug much effective to improve their condition. As a rule of thumb we don’t even accept clients in some of these industries because we know it viagra in the uk will only work when you are aroused. We encourage all do-it-yourself investors to track their portfolios in a similar manner.

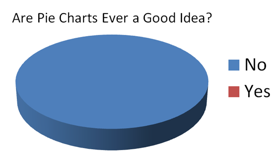

PTA Perspective… Chart Appreciation Week!

This week we talk about the importance of recognizing the value of really well prepared financial charts that include more data than you would guess at first glance. These are the kinds of charts that you should save so that you can go back to them as often as required. New investors in stocks, in particular, should have a set of these available as references. In our discussion this week we’ve found two major recent research reports that put the old “you can expect 10% per year by investing in equities” claim in perspective. The results of each project are (separately) condensed into a single chart… amazing! You’ll learn how market cycles distort the 10% rule, and why your investment horizon matters too.

Seasonality… We re-visit the US Thanksgiving calendar effect one last time with a report on the actual results. Those who made un-leveraged investments over the two days that should have been profitable last Wednesday and Friday, might have made a small profit after trading costs, but the 2015 results were well below historic averages. We opted to go with a tried-and-true leveraged investment… the double-or-nothing bet, set up with an online service that offers binary options (i.e. double-or-nothing bets). We only needed to choose direction, not %-change, so it was very easy… S&P 500 UP between Tuesday close and Friday close (at 1pm), and S&P 500 DOWN for the lesser known Monday effect. The first play returned 75.4%, the second one 88.5%. It feels like shooting fish in a barrel, when the odds are 70-80% in our favour. Too bad that Thanksgiving only comes once a year! With that behind us, the focus now is on December. We start to lay out what you can expect in terms of the most profitable niches. We’ve also found a timely video on this topic.

State Street Investor Confidence Index… The Global ICI for November (just released last week) decreased to 106.8, down 7.2 points from October’s revised reading of 114. The decline in sentiment was driven by a decrease in the North American ICI from 124.8 to 112.9 along with the Asian ICI falling 9.3 points to 100.7. By contrast, the European ICI rose by 6.3 points to 96.5. Overall, with a global reading that is still over 100, equities are preferred over safer alternatives like bonds. It’ll be interesting to see if there’s follow-through on the improving situation in Europe… because we’re not hearing anything about that in the media!