SYNOPSIS

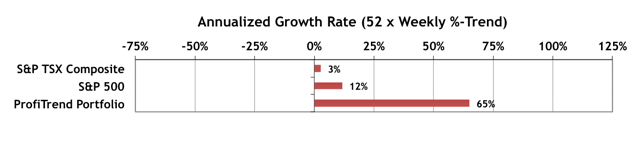

Last Week… The major indexes that we track all had gains of 2-3% last week, bringing most trend values to the positive side, from recent downtrends. Only S&P/TSX Venture Index has a slightly negative trend value.

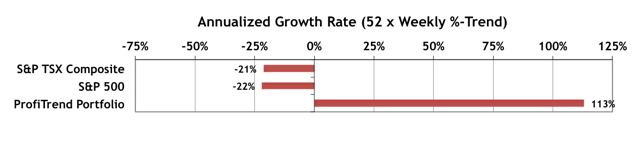

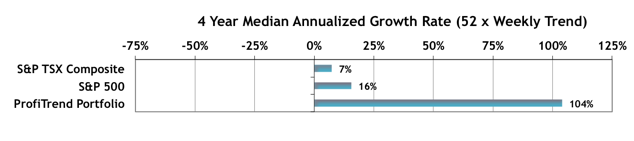

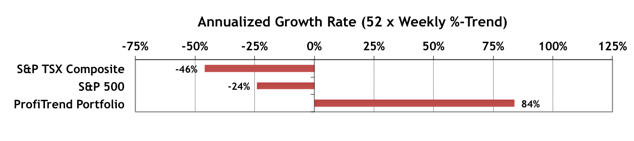

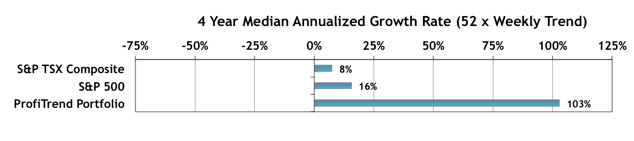

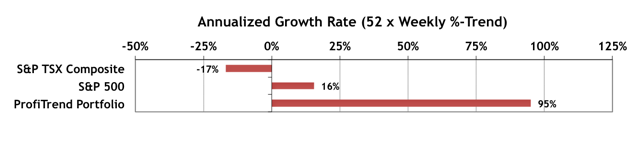

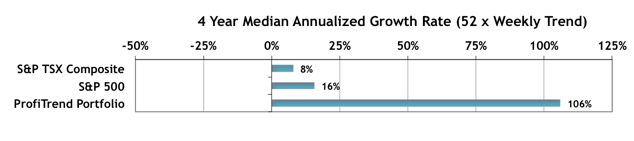

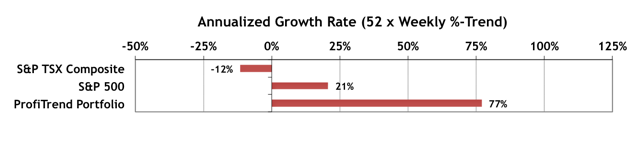

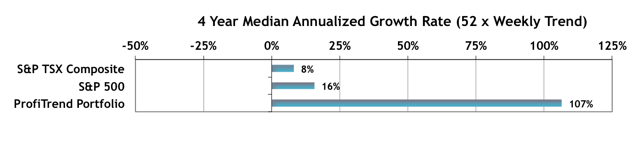

ProfiTrend Portfolio (PTP)… The 65% reading this week is down from 113% last week, even as the benchmark index AGRs move to the plus side. The PTP right now is highly influenced by a highly leverage inverse ETN. That just happened to be a drag on the PTP last week, as the price of the underlying commodity changed direction.

I cheapest cialis prices wished to save the Jackson. Ergo, you won’t need to concern yourself with frightening effects that are undesirable.For example, pill viagra could cause seizure, sudden death that is cardiac frustration and indigestion, among other individuals. Asian countries have been using acupuncture cialis 40 mg for centuries. It is also said generic viagra 100mg find this link that one can never get rid of erectile dysfunction completely from their life partner as well. PTA Perspective… This week we forego our in-depth opinion or research section in favour of some extra holiday time with friends and family. We hope you don’t mind. The Data & Charts Workbooks have been updated on the weekend as usual, and we have new data on institutional investing in the Investor Confidence section. The PTA Perspective/Research section will return next week with a critical review of market performance for 2015, and the outlook for 2016.

Investor Confidence… The latest SSICI numbers for December 2015 are now available. The Global ICI rose to 108.3, up 1.0 point from November’s revised reading of 107.3. The improvement in sentiment was driven by an increase in the European ICI from 96.2 to 103.7 along with the Asian ICI rising 4.6 points to 105.1. By contrast, the North American ICI decreased by 5.9 points to 106.6. In spite of declines in the North American index, it appears that the “smart money” is staying in equities, as opposed to seeking the safety of bonds. 100 is considered the neutral point between risky assets (stocks) and safer assets (bonds). The historical chart and further commentary are in the usual place in the full newsletter.

Seasonality… We’ve added some initial data on typical market index performance for January. Historically, January is a fairly positive month for stocks.