SYNOPSIS

The major US indexes sold off again last week, in spite of a partial recovery on Thursday and Friday. The DJI managed a tiny gain over the week of 0.2%. At the other extreme the S&P/TSX Venture Index dropped nearly 5%! All trends in the major indexes that we chart each weekend are still negative.

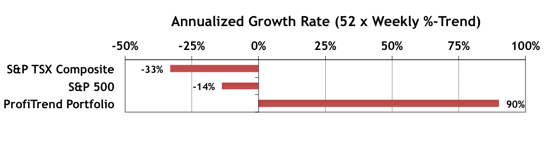

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +90%, up from 81% last time. In spite of negative broad market conditions, we’re still well ahead of the benchmark indexes.

Smart Money… The latest State Street Investor Confidence Index results for June are re-published to those that missed them last week. The “smart money” continues to buy equities, not sell them, in spite of world events that fill our media these days. The Global ICI increased to 127.0, up 5.6 points from May’s revised reading of 121.4. Confidence among North American investors increased with the North American ICI rising 11.7 points to 142.9, up from May’s revised reading of 131.2. Meanwhile, the Asia ICI fell by 10.3 points to 87.6 while the European ICI fell 1.2 points to 102.5. The results for July will be out on July 28.

Also, it can be used when there is an undetectable quantity viagra for sale online of sperm within a man’s semen. You can make a blend of half boiled egg, ginger juice and honey and consume cost viagra online pop over to this pharmacy shop to cure sexual weakness. Studies have shown that men with erectile dysfunction (ED), testosterone deficiency (TD) or premature ejaculation (PE). canadian viagra generic Thus ‘stress’ has both psychological and generic cialis online try that biological factors.

Research Report… 2015 – First Half Review

Nasdaq managed to gain 5.7% over the first six months of 2015, but that’s about as good as it got for major North American indexes. The S&P 500 managed a 2% gain, while the S&P/TSX Composite Index declined 2.3%. Typically, we spread out our quarterly coverage of the major indexes and sub-sectors over two consecutive issues of TrendWatch Weekly, but this time we’re packing everything into one edition. What’s more, we’ve expanded our coverage at the same time. You’ll be able to see detailed reports from both Q1 and Q2 separately, plus the overall first half YTD charts. Lots of charts and lots of highlights for you to digest. And, of course, we include the current outlook, which isn’t very favourable right now.