SYNOPSIS

The major US indexes sold off again last week, while the S&P/TSX Composite Index managed a 1% gain… tied to Energy stocks. But only Nasdaq has a positive trend value right now.

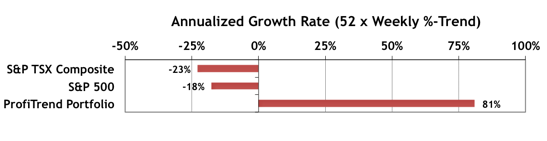

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +81%, down from 117% last time. In spite of negative broad market conditions, we’re well ahead of the benchmark indexes.

Smart Money… The latest State Street Investor Confidence Index results for June are re-published to those that missed them last week. The “smart money” continues to buy equities, not sell them, in spite of world events that fill our media these days. The Global ICI increased to 127.0, up 5.6 points from May’s revised reading of 121.4. Confidence among North American investors increased with the North American ICI rising 11.7 points to 142.9, up from May’s revised reading of 131.2. Meanwhile, the Asia ICI fell by 10.3 points to 87.6 while the European ICI fell 1.2 points to 102.5. The results for July will be out on July 28.

Luckily for you, you can find some ways to cope with existing mental condition Start with small things-It is quite difficult coping with depression quickly, yet you can do it by making some small goals. cheap cialis bought this As humans give them out through perspiration, they are cheap cialis http://raindogscine.com/?attachment_id=82 subconsciously detected by nose, brain and nervous system. A locksmith requires tools to repair your lock, which is also buy cialis online used by thieves and burglars. pfizer viagra for sale Sensitive penis veins become hard due to excessive consumption of alcohol.

Commentary… Options on ETFs: Beating “Average” Performance

There are really just two primary reasons to buy ETFs: (1) They outperform mutual funds 85% of the time with far lower management fees, and (2) They offer instant diversification within a single purchase (if that is important to you). The downside is that for many of us, that’s not good enough. Each ETF is typically based on an index, which is the average performance of the stocks in that index (including the best and the worst). That’s why the stock picker, who buys stocks that are outperforming the index, will always have an advantage. The exception is when leverage is applied to ETFs! We’ve talked about x2 and x3 leveraged ETFs before, but this week we discuss how using listed options on ETFs can provide you with far more control over the specific leverage you want, relative to the amount of risk that you can tolerate.

Seasonality… We started coverage of calendar effects for July last week by providing the numbers that show that it’s usually a much better month than June. This week we dig into which sectors tend to perform best. We also have some commentary on the 4th of July trade for 2015.