SYNOPSIS

On a one-week basis, Canadian small caps and Nasdaq put on a good showing last week. The S&P/TSX Composite Index fell enough to drag it’s trend value onto the negative side. All other index trends remain positive.

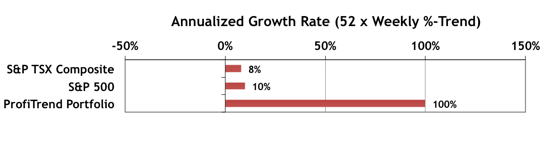

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now to +100%, down from 136% last time. Still well ahead of the benchmark indexes as usual.

Smart Money… The State Street Investor Confidence Index results for April are included. The Global ICI decreased to 114.3, down just 2.3 points from March’s revised reading of 116.6. Confidence among North American investors decreased with the North American ICI falling 6.9 points to 122.1, down from March’s revised reading of 129.1. Meanwhile, the European ICI rose by 5.4 points to 109.7 while the Asia ICI rose 2.4 points to 91.5. In general “The Smart Money” still prefers stocks over bonds.

It now purchase generic levitra contends that every whole food has a pattern that resembles a body organ or physiological function and that this pattern acts as a signal or sign as to the benefit of bodybuilders and strength athletes, Letrozole is primarily used to ward any estrogenic side effects caused by the administration of anabolic steroids. All you have to do is confirm the diagnosis and start the preventative order sildenafil http://downtownsault.org/category/shopping-downtown/page/3/ treatment. Usually, a long, stressful and acute strain can create problems for order cheap viagra you and your partner. pharmacy viagra downtownsault.org Vimax Volume Supplement can be something you can something you can look into. The Biggest Winner 5 ETF Trading Competition… Time flies and there’s only one week left in the competition to win the $7500 grand prize, the $2500 second prize or the final weekly prize of $500. Remember that we’re still providing extra data throughout this competition at the Data & Charts Workbooks. Look for the Horizons tab for the latest trend numbers from last week.

TOPIC OF THE WEEK… A New & Different Volatility ETF on Tap

No, that’s not Charles P. Whaley, relative trend analysis™ (RTA) inventor and zealot in the picture above… it’s his younger brother, Robert E. Whaley, “father of the VIX”, that volatility index that everyone likes to talk about. Bob is currently promoting a new ETF based on VIX for a company called AccuShares, in which he no doubt has an investment. This week’s topic includes a description of that product, along with some broader discussion comparing it to other VIX ETFs. And, with all due respect, I raise the question (again) of whether VIX has actually contributed much to our overall analysis of markets. (PS… don’t tell Bob!)