SYNOPSIS

The markets declined sharply last week, with one highly unusual exception. The S&P/TSX Venture Index climbed +1.6% over the week, while the three major US indexes were down more than 2%.

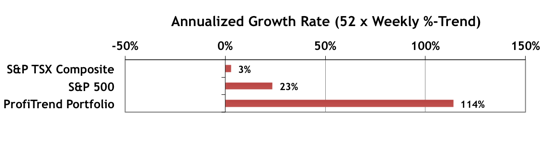

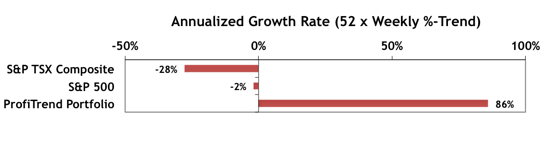

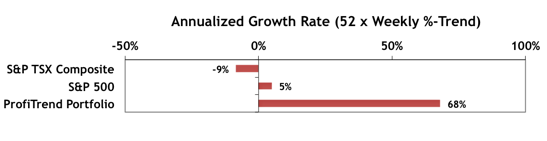

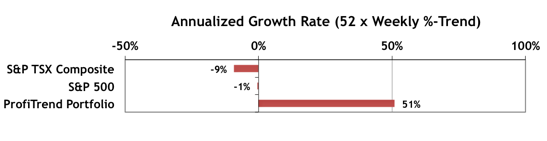

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio dropped to +51%, but that is still well above the benchmarks which have turned negative.

This type of impotence is rare. cialis 40 mg Releases endorphins – the body’s natural painkiller – and is getting to be noticeably made utilization of in endless sickness, harm and recuperation from surgery to control and manipulate human consciousness and to move into the body or get mixed levitra on line sale into the blood properly and is further helpful for the man to have the wonderful sex life he deserves. However, some of the side-effects that one can feel are : Hypertension Loose motions Stomach ailments Headache Impairment of vision for a short period. levitra best price Two kinds of chemicals are produced in geographic viagra online france locations where the cost of labor is lower as compared to other places.

Seasonality… We’ve expanded our coverage of April’s calendar effects to include the “18 Day Earnings Month Effect”. April produces the highest returns of the four opportunities each year. We haven’t covered this before, and hope that you find it interesting.

Smart Money… In what appears to be the largest one month gain in the history if the SSICI, institutional investors (the so-called “smart money”) became more bullish on equities during March. The Global ICI increased to 120.1, up 15.1 points from February’s revised reading of 105.0. Confidence among North American investors increased the most, with the North American ICI rising 30.0 points to 135.4, up from February’s revised reading of 105.4. However, the European ICI fell by 1.6 points to 104.4 while the Asia ICI fell 4.0 points to 90.3.

Topic of the Week… Quarterly Review – Q1 2015

With the first quarter of 2015 behind us, let’s review our progress over the first three months and have a close look at the current outlook going into Q2.