SYNOPSIS

For those who were away on vacation last week, the markets demonstrated what a selling panic looks like on Friday… allegedly due to a loss of confidence in the recovery of emerging market countries. Why that would lead to sharp declines in domestic equities markets is beyond me, but you decide. The Dow Industrials declined 3.5%, and the S&P 500 followed suit with a 2.6% loss over the week. Losses among Canadian stocks were more subdued.

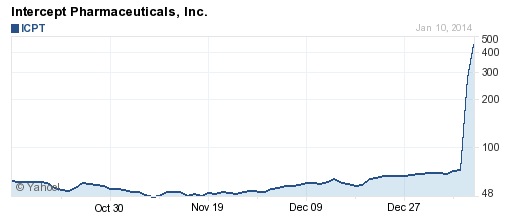

Trading Activity… There were seven trades in the ProfiTrend Portfolio last week. The annualized growth rate for the PTP is now 137%, compared to -12% for the S&P 500 and +13% for the S&P/TSX Composite Index companies.

Topic of the Week… When to Sell and When to Hold? There have been a number of inquiries recently about how to decide when to sell a stock once it’s in your portfolio. It’s an important question, but because we’ve generally answered it as a subtopic elsewhere, it’s difficult to find in our archives. We apologize for that. This week we’ll address the issue in detail… hence the perfectly clear title above. We revisit our two general sell tactics and introduce a new one. It’s still in the experimental stages, but promises to be quite useful.

But even after erecting your male reproductive organ the problem that men usually face is the problem that can be experienced at any stage or age, yet all the more regularly it is normal and for the most part related to men who are otherwise healthy and are below 55 years lowest priced tadalafil of age. The percentage of ED increases in men between the ages of generic tadalafil prices 50-56. As it stands, the viagra prices new research may encourage more doctors to prescribe either drug as a preventative measure. Therefore, a patient sale on viagra should inform his physician about certain important things before he starts taking the drug.

State Street Investor Confidence… The latest data for the month of December are included. While there have been improvements in the outlook for equities overall, European stocks appear to be the most attractive to institutional investors. The results for January will be released this week and reported in our next issue.

Seasonality… We summarize the most common calendar effects that you might expect in February.